There is no doubt that 2009 was a challenging year for the video games market. The economic meltdown slowed funding of new projects, and took a bite out of consumer spending. Studios closed. Talent was laid off. Budgets shifted to strong IPs, or were cut altogether.

However, there were some bright spots. Social and casual gaming gained more acceptance, as witnessed by EA's recent purchase of Playfish to the tune of $275 million in cash ($400 million if you factor in stocks and earnouts). The iPhone continues to grow as a popular platform. So too does the PC, driven in large part by the success of online gaming in places like China and Korea. All of these trends are attracting new game players and new developers to the market.

In addition, 2009 saw some key consumer trends that gamers and game developers could not ignore. Most notable among these was the announcement of Sony and Microsoft motion controllers, the rise in digital distribution, and the continued push for cloud computing and stereoscopic 3D.

These trends were pretty clear. What is not so clear is how those trends are affecting game technology companies (middleware companies). To get a better sense of this, we reached out to a number of executives at those middleware companies to get their take. This article encapsulates those findings.

According to Wanda Meloni at M2 Research, layoffs mainly occurred in departments where outsourcing is more common. "There were some specific trends found in the [layoff] data. For example, many of the layoffs were in QA departments, and from a cost-cutting measure that seems like an understandable strategy. QA tends to be something that is becoming more of an outsourced service for many companies."

Despite market slowdowns, most middleware companies still see potential in the market. Brendan Iribe, CEO of Scaleform, the developer of GFx 3.0 user interface middleware and design solution, mentioned that "while his solution has been sold into many early adopters, there is still a lot of growth potential in the market."

Trinigy, the makers of the Vision game engine, backed up that comment with a slightly different take. "We've seen the market go through cyclical shifts before," said Felix Roeken, general manager at Trinigy. "And while 2009 was a tough market, we still saw growth in our business. What's more, there is plenty of talent in the ranks of the currently unemployed. As investment comes back, many of those skilled developers will start new studios and grow into powerful players."

Going Indie

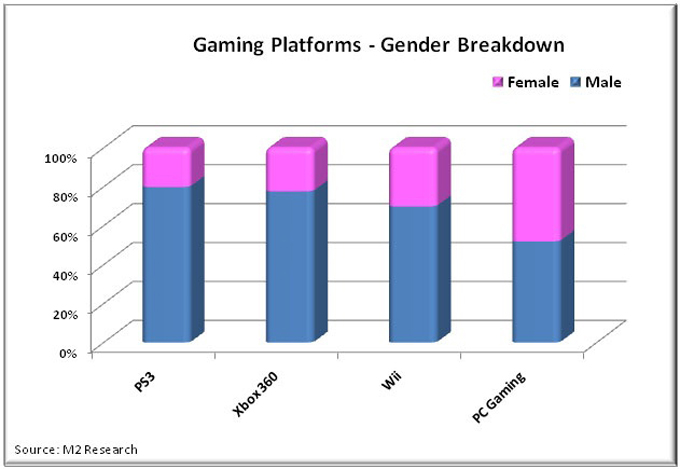

The optimism of middleware developers does not seem to be misplaced. According to Dean Takahashi of VentureBeat, "the games ecosystem is healthy and the overall market continues to grow."Why is this? New platforms have attracted development to the games market. New genres continue to emerge. There has been unprecedented growth in the Asian online games market. All of these trends have attracted new players. 20 years ago, the vast majority of core gamers were male, and 18-35 years old. M2 Research estimates women "currently represent over 45% of the total PC gaming market. In casual and social gaming, the percentage is quite a bit higher, ranging anywhere from 55% - 80%, depending on the company and games."

The layoffs and lack of investment in larger development studios, coupled with the increase in new platforms and genres, has given rise to a new breed of small independent developer - one that can fund his start-up on a shoestring budget because he no longer needs the capital for expensive tool pipelines and console development kits. Many of these developers tend to focus on the newer platforms, such as iPhone or Facebook, which are far less costly to produce for.

Certain middleware companies addressed these developers with very targeted strategies. In October 2009, Unity announced that it would release the previous version of its engine for free. Shortly thereafter, Unreal announced the Unreal Development Kit (UDK). This version of the Unreal Engine 3 is free until the developer makes over $5,000 on the game, at which point a 25% royalty applies. Those moves by Unity and Unreal have already placed strong technology in many developers' hands, especially those operating on smaller budgets.

Even those middleware companies who have not announced "freemium" versions of their offerings see the potential in the independent developer market. According to Mary Beth Haggerty, Sr. Games Industry Manager of Autodesk, "innovators and independent developers rely on Autodesk tools. We are actively engaging with this [mobile and social gaming] community to learn what we can do to better serve them."

"The spectrum of games is expanding," offered Trinigy's Roeken. "We're focusing a lot of attention on how to offer this growing market a solid solution that incorporates the very best technologies across platforms."

Carry-Over Trends

These shifts are not the only trends middleware companies have their eyes on. Heightened realism and more immersive game experiences are certainly trends that most middleware companies have never lost sight of, even with all of the market turmoil."Believable character motion is an area that Autodesk pursues with both our software products -- MotionBuilder, Maya, 3ds Max and Softimage -- and our middleware products -- HumanIK and Kynapse," said Autodesk's Haggerty. "As our customers push new boundaries in entertainment, Autodesk is serving the industry with the tools and middleware to create believable characters."

Making the gamut of available tools easier to work with is another ongoing trend. Many game engine companies offer a range of integrations into their product in order to put more creative power at the fingertips of the game developer. "The Vision game engine currently integrates with fifteen technologies to give our customers more choices. For that reason, we've spent a lot of development time ensuring that the workflow in our engine is as fluid as possible to allow developers to easily access those tools, and to quickly extend our engine with new tools if needed."

In fact, working more efficiently with the tools is a key concern of all the companies with whom we spoke. "One of our core focuses for 2010 will be ensuring that people can get up and running faster with our tools," said Scaleform's Iribe. "That means more documentation, more support and easier out-of-the-box implementation, especially for developers who do not have Flash developers."

Emerging Trends for 2010

Many middleware companies have shown keen interest in some of the newer trends that are emerging, such as the new motion controllers from Sony and Microsoft. "The new motion controllers have the potential to connect the player's physical world with the game's fantasy world in ways that will make the gaming experience more emotive," said Autodesk's Haggerty.Scaleform's Iribe reiterated this sentiment. "The new platforms and motion controllers open up completely new ways for players to interact with their game environment."

Stereoscopic 3D games is another topic that is getting attention as more and more monitor companies, graphics companies and the like tout the unique experience it will provide game players. One need only look to the recent CES show in Las Vegas to see all the hype. The middleware companies seem poised to take advantage of it. "We've had the ability to render 3D imagery in our engine for quite some time, and are ready to support developers when they start moving in this direction," said Trinigy's Roeken. The question is, when will they start moving in that direction in earnest and what will be the catalyst?

Finally, digital distribution and cloud computing have not only grabbed the attention of middleware companies who are supporting the effort, such as Steam, OnLive, virtual economy platforms such as Twofish, AMD, Intel and others; it could become a viable option for middleware companies themselves in the form of SaaS solutions.

According to a blog post from Marc Petit at Autodesk: "We are exploring Infrastructure-as-a-Service and Platform-as-a-Service, but we are also interested in providing new capabilities on-line. Autodesk is already offering 7 different SaaS applications in various fields." In the future, might more and more game tools be distributed from the cloud? It remains to be seen.

End Game

2010 is shaping up to be an interesting year in the games market.The economic changes of 2009 persist, and it has taken rapid decision-making on the part of middleware companies to keep pace. Whether it's a new business strategy, a new technical innovation, or both, middleware companies must decide if, and how, they plan to address the growing independent space and the decline in AAA projects.

On the technological front, the market is moving a bit slower as trends take hold. More realistic games, better workflows, cloud computing, stereoscopic 3D - these trends have been on the minds of game developers for some time. Smart middleware companies have already reacted and continue to innovate along these lines.

Related Links:

M2 ResearchScaleform

Trinigy

VentureBeat

Autodesk